Nitinol tubing wholesale pricing for medical devices in 2025

Nitinol tubing wholesale pricing for medical devices in 2025 ranges from $8.80 per piece to $750 per unit, or $110 to $380 per kilogram. Prices shift widely based on tubing size, specification, and order quantity. For example, premium braided or platinum-cured tubing in small quantities can cost much more per unit than standard tubing ordered in bulk.

Tubing Specification & Size | Order Quantity | Total Price (USD) | Price Variation Insight |

|---|---|---|---|

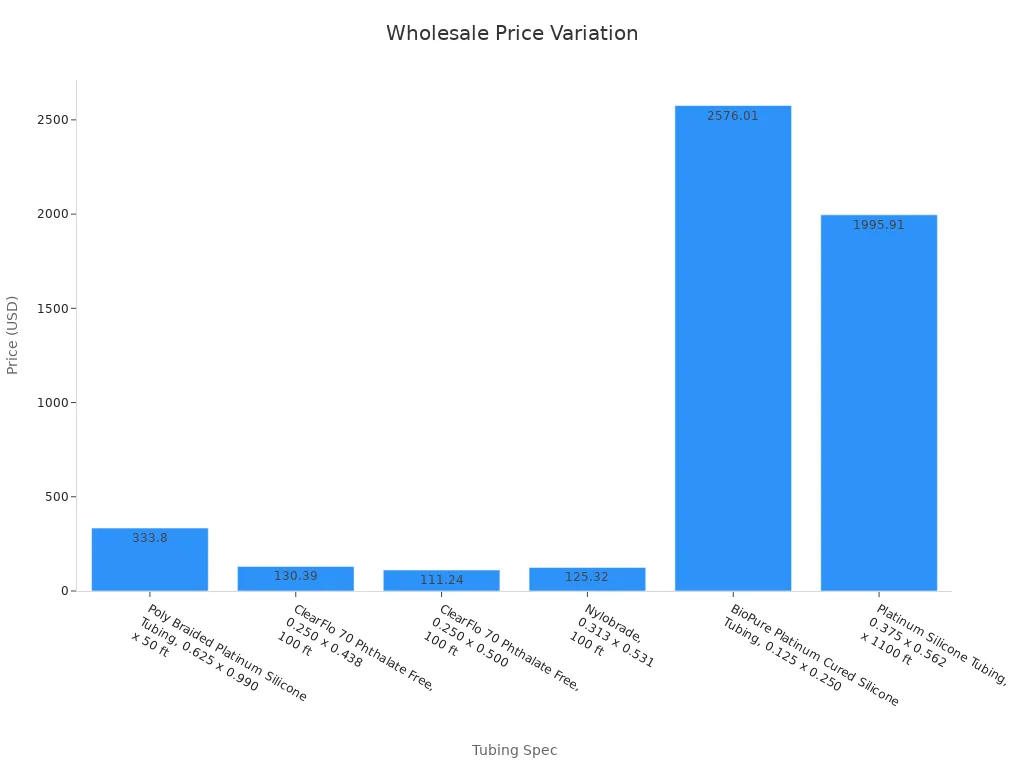

Poly Braided Platinum Silicone Tubing, 0.625" x 0.990" x 50 ft | 50 ft | $333.80 | Smaller quantity, larger diameter tubing with braided platinum curing commands higher per-unit price |

ClearFlo 70 Phthalate Free, 0.250" x 0.438" x 100 ft | 500 ft | $130.39 | Larger quantity order shows lower per-foot price for smaller diameter tubing |

ClearFlo 70 Phthalate Free, 0.250" x 0.500" x 100 ft | 300 ft | $111.24 | Mid-sized order quantity with slightly larger diameter tubing has a lower total price than smaller quantity larger tubing |

Nylobrade, 0.313" x 0.531" x 100 ft | 300 ft | $125.32 | Different specification (Nylobrade) affects price compared to ClearFlo at similar quantity and size |

BioPure Platinum Cured Silicone Tubing, 0.125" x 0.250" | 64 units | $2,576.01 | Small quantity but very high total price indicating premium specification and possibly smaller unit size with higher per-unit cost |

Platinum Silicone Tubing, 0.375" x 0.562" x 1100 ft | 1100 ft | $1,995.91 | Very large quantity order with mid-size tubing shows lower per-foot price, demonstrating quantity discount effect |

Supplier, location, and recent market shifts affect costs. Procurement professionals and engineers should compare suppliers, order volumes, and specifications to secure competitive pricing and meet strict medical device standards.

Key Takeaways

Nitinol tubing prices vary widely in 2025, ranging from $8.80 per piece to $2,000 per kilogram depending on size, specification, and order quantity.

Smaller diameters, premium specifications, and custom designs increase costs due to complex manufacturing and strict quality standards.

Ordering larger quantities lowers the price per kilogram thanks to volume discounts and economies of scale.

Supplier location affects pricing; Asian suppliers offer lower base prices, while US and European suppliers provide higher quality and certifications at higher costs.

Buyers should compare suppliers, check certifications, negotiate discounts, and consider total landed costs to secure the best value and ensure medical-grade quality.

Nitinol tubing wholesale pricing for medical devices

2025 price range overview

Nitinol tubing wholesale pricing for medical devices in 2025 shows significant variation across suppliers and regions. Medical-grade nitinol tubing, especially for fine diameters, typically costs between $70 and $100 per kilogram. Industrial-grade tubing is less expensive, with prices ranging from $0.7 to $10 per kilogram in China and $75 to $85 per kilogram on global supplier portals. Suppliers such as Alibaba, Chamfr.com, and Geenitinol.com list prices that reflect these differences. Medical-grade tubing commands a premium due to strict quality and certification requirements. Transparent pricing from suppliers helps buyers plan budgets and avoid unexpected costs. Reliable suppliers often provide detailed cost breakdowns, which builds trust and supports long-term partnerships.

Note: While lower prices may seem attractive, buyers should always consider quality and certification. Medical applications require tubing that meets high standards for durability and precision.

Price by size and specification

The size and specification of nitinol tubing play a major role in determining price. Tubing with smaller diameters or tighter tolerances costs more due to increased manufacturing complexity and stricter quality control. For example, medical-grade shape-memory nitinol guide wires with a 0.1 mm diameter are priced at $70 to $100 per kilogram, while general nickel-titanium wire can be as low as $0.75 per kilogram for large orders. Specialty tubing, such as custom-engineered alloys or platinum-cured products, can reach $800 to $2,000 per kilogram. Certifications like ISO 13485, AS9100, and ASTM F2063 also add to the cost, as they require additional testing and documentation.

Specification Type | Diameter Range | Price Range (USD/kg) | Certification Impact |

|---|---|---|---|

Industrial-grade tubing | 0.5–2 mm | $0.7–10 | Low |

Medical-grade tubing | 0.1–0.2 mm | $70–100 | High |

Custom-engineered alloys | Any | $800–2,000 | Very High |

Price by order volume

Order volume has a direct impact on nitinol tubing wholesale pricing for medical devices. Larger orders benefit from economies of scale, resulting in lower prices per kilogram. Standard nitinol alloys with a minimum order quantity (MOQ) of 200 kg are priced between $300 and $500 per kilogram. Custom-engineered alloys, which often have a lower MOQ of 20 kg, can cost $800 to $2,000 per kilogram due to higher production complexity and lower yields. Bulk discounts and flexible payment terms from suppliers further improve cost-effectiveness for large buyers.

Aspect | Standard Nitinol Alloys | Custom-Engineered Nitinol Alloys |

|---|---|---|

Price Range (per kg) | $300 - $500 | $800 - $2,000 |

Minimum Order Quantity (MOQ) | 200 kg | 20 kg |

Pricing Premium | Baseline | 200% - 400% premium |

Production Yield | 92% | 75% |

Post-Processing Cost % | 15% | 40% |

Lead Time | 30 - 45 days | 90 - 120 days |

Procurement professionals should compare order volumes and supplier terms to secure the best value. Nitinol tubing wholesale pricing for medical devices depends not only on the quantity ordered but also on the complexity of the product and the reliability of the supplier.

Price factors

Raw material and processing costs

Nitinol tubing pricing depends heavily on the cost of raw materials, especially nickel and titanium. Titanium extraction and refinement involve complex, multi-stage processes, making it one of the most expensive elements in the alloy. Nickel prices also fluctuate due to geopolitical and trade issues, which can cause sudden changes in production budgets. Manufacturers must use advanced processing techniques such as gun drilling, laser cutting, and electropolishing. Gun drilling, for example, removes a large portion of the nitinol bar to create the tube hollow, resulting in significant material loss and higher costs. Each additional step, like shape setting or electropolishing, adds time and requires skilled labor. The need for precise temperature control and specialized packaging further increases expenses. These factors combine to make nitinol tubing more costly than other forms like wire or sheet.

Note: The thermal sensitivity of nitinol demands careful handling throughout the manufacturing process to maintain quality and performance.

Manufacturing and customization

Manufacturing nitinol tubing for medical devices involves several advanced techniques. Precision alloying, heat treatment, and additive manufacturing require specialized equipment and highly trained workers. Customization, such as patient-specific stent designs or micro-patterned surfaces, increases both complexity and cost. Clinical studies show that customized nitinol stents achieve high technical success rates and long-term effectiveness, but these benefits come with higher production expenses. Manufacturers must also optimize process parameters like energy density and scanning speed to ensure the tubing meets strict medical standards. Regulatory compliance, including ISO 13485 certification, adds further operational costs but guarantees product reliability.

Customization options, such as AI-driven designs, require advanced testing and design work.

Eco-friendly practices, like closed-loop recycling, help reduce waste and control costs.

Stringent quality control ensures consistent performance but increases operational expenses.

Supplier location and shipping

Supplier location and shipping logistics play a major role in nitinol tubing pricing. Most nitinol tubing comes from a few major suppliers, which creates supply risk and potential price volatility. Regional supply chain differences, such as labor costs and regulatory requirements, also affect final pricing. For example, suppliers in Asia may offer lower base prices, but shipping costs and lead times can offset these savings. Companies often diversify their supply chains, invest in automation, and pursue vertical integration to reduce risks and control costs. Growing demand in medical and aerospace sectors puts additional pressure on suppliers, influencing both availability and price.

Factor | Description |

|---|---|

Supplier Concentration | Few major suppliers increase supply risk and price volatility |

Raw Material Price Volatility | Nickel and titanium prices fluctuate, impacting production costs |

Regulatory Compliance Costs | Compliance with standards increases costs by up to 22% |

Production Challenges | Trial failures and approval delays raise costs and extend lead times |

Market Demand Trends | Rising demand in medical and aerospace sectors increases pricing pressure |

Supply Chain Mitigation | Diversification and automation help control costs and reduce supply risks |

Tip: Buyers should compare suppliers from different regions and consider total landed costs, not just base prices, to make informed sourcing decisions.

Supplier and region comparison

Global supplier pricing

Major suppliers of nitinol tubing operate on international platforms such as Alibaba, Made-in-China, and Global Sources. Chinese suppliers lead the market, offering high shipment volumes, reliable networks, and competitive prices. These platforms allow buyers to compare prices, check certifications, and review supplier ratings. Volza’s import and export data shows that China holds over 55% of the global market share for nitinol tubing exports. The United States and France follow as significant exporters. Buyers can use Volza’s tools to analyze shipment frequency, volume, and pricing trends. This helps them identify dependable suppliers and optimize their sourcing strategies.

Supplier Platform | Region | Market Share (%) | Key Features |

|---|---|---|---|

Alibaba | China/Global | 55+ | Cost advantage, customization, certifications |

Made-in-China | China/Global | 55+ | Fast delivery, verified suppliers |

Volza | Global | N/A | Price comparison, shipment data, FTA insights |

Chamfr.com | US/Global | N/A | Medical-grade focus, quick quotes |

Resonetics/Confluent | US/Europe | N/A | Premium quality, advanced customization |

Buyers benefit from transparent pricing and shipment data, which supports informed decisions and supply chain optimization.

Regional trends

Regional differences play a big role in nitinol tubing wholesale pricing for medical devices. Chinese suppliers usually offer the lowest base prices and flexible minimum order quantities. They also provide fast production and shipping for bulk orders. In the United States, companies like Chamfr.com, Resonetics, and Confluent Medical focus on medical-grade tubing with strict certifications. These suppliers often have higher prices but offer advanced customization and shorter lead times for North American buyers. European suppliers maintain high quality standards and serve specialized markets, but their prices tend to be higher due to labor costs and regulatory requirements.

Asian suppliers: Lower prices, large order capacity, flexible MOQs

US suppliers: Higher prices, strict certifications, premium customization

European suppliers: Highest prices, specialized products, strong compliance

Buyers should compare total landed costs, including shipping and import duties. Platforms like Volza help buyers find suppliers with low or zero import duties through Free Trade Agreements. This can make sourcing more cost-effective, even from regions with higher base prices.

Sourcing tips and quality

Negotiation and discounts

Procurement teams often secure better nitinol tubing prices by using strategic negotiation. Buyers can request volume discounts when placing large orders. Suppliers usually offer tiered pricing, so higher quantities lead to lower per-unit costs. Companies should compare quotes from multiple suppliers to identify the most competitive rates. Many suppliers provide sample tubing at reduced prices, which helps buyers evaluate quality before committing to a large purchase.

Buyers can also negotiate for flexible payment terms or bundled services, such as expedited shipping or custom packaging. Some suppliers offer seasonal promotions or loyalty discounts for repeat customers. Building a strong relationship with a supplier can result in priority production slots and early access to new product lines.

Tip: Always clarify minimum order quantities and lead times before finalizing a deal. This prevents unexpected delays and ensures the supplier can meet project deadlines.

Quality and certification

Quality and certification play a critical role in sourcing nitinol tubing for medical devices. Suppliers with certifications like ISO 13485 and FDA 21 CFR Part 820 follow strict manufacturing and quality control standards. These certifications require advanced sterilization protocols and detailed documentation. A leading European manufacturer reported a 22% increase in compliance costs after upgrading sterilization processes.

Despite higher costs, certified suppliers justify premium pricing by offering tubing with lower failure rates and improved reliability. Medical device companies benefit from reduced risk and lower total ownership costs over time. Certified suppliers also provide strong customer support and maintain reliable supply chains, which adds value for buyers.

Certified suppliers command higher prices due to added safety, customization, and durability.

Quality certifications directly influence the cost structure and pricing strategies of nitinol tubing suppliers in 2025.

Procurement professionals should always verify supplier certifications and request supporting documentation. This ensures the tubing meets regulatory requirements and performs reliably in medical applications.

Nitinol tubing wholesale pricing for medical devices in 2025 ranges from $8.80 per piece to $2,000 per kilogram. Several factors shape these prices:

Raw material and processing costs

Manufacturing complexity and customization

Supplier location and shipping fees

Regional trends show lower prices in Asia and higher costs in the US and Europe. Buyers should compare suppliers, check certifications, and focus on quality to ensure safe and reliable medical devices.

FAQ

What is the typical lead time for nitinol tubing orders in 2025?

Most suppliers deliver standard nitinol tubing within 30 to 45 days. Custom-engineered tubing may require 90 to 120 days. Buyers should confirm lead times before placing orders.

How do suppliers ensure medical-grade quality for nitinol tubing?

Suppliers follow strict quality control processes. They use certifications like ISO 13485 and ASTM F2063. These standards require testing, documentation, and advanced sterilization.

Can buyers request samples before placing large orders?

Yes, many suppliers offer sample tubing at reduced prices. This allows buyers to check quality and compatibility before committing to a bulk purchase.

What factors most affect nitinol tubing prices?

Raw material costs, manufacturing complexity, order volume, and supplier location all impact pricing. Certification and customization also increase costs.

Are there ways to reduce shipping costs for international orders?

Buyers can consolidate shipments, choose suppliers closer to their region, or use Free Trade Agreements. These steps help lower total landed costs and speed up delivery.

See Also

The Future Impact Of Nitinol Tubes On Medicine

Nitinol Tubing Transforming The Medical Device Industry

The Process Behind Manufacturing Nitinol Tubing For Healthcare

Discovering Various Uses Of Nitinol Tubing In Medicine

Nitinol Tubing’s Contribution To Medical Technology Progress